India's 2025 Stock Market Crash: Causes, Consequences, and Comeback Strategy

Introduction

In June 2025, one of the most turbulent periods was seen by the Indian stock market. Within a span of three days, investors’ wealth worth billions was wiped out, causing the winds of panic and concern to spread far and wide. Both indices, Sensex and Nifty, descended in greater waves than usual, reflecting the panic and uncertainty gripping the land. This blog tries to delve into the cause, the consequences, as well as the learnings to be imbibed from this crash.

This analysis of the India stock market crash 2025 will also highlight how global macroeconomic trends and domestic political uncertainty shaped the course of events.

What Really Happened?

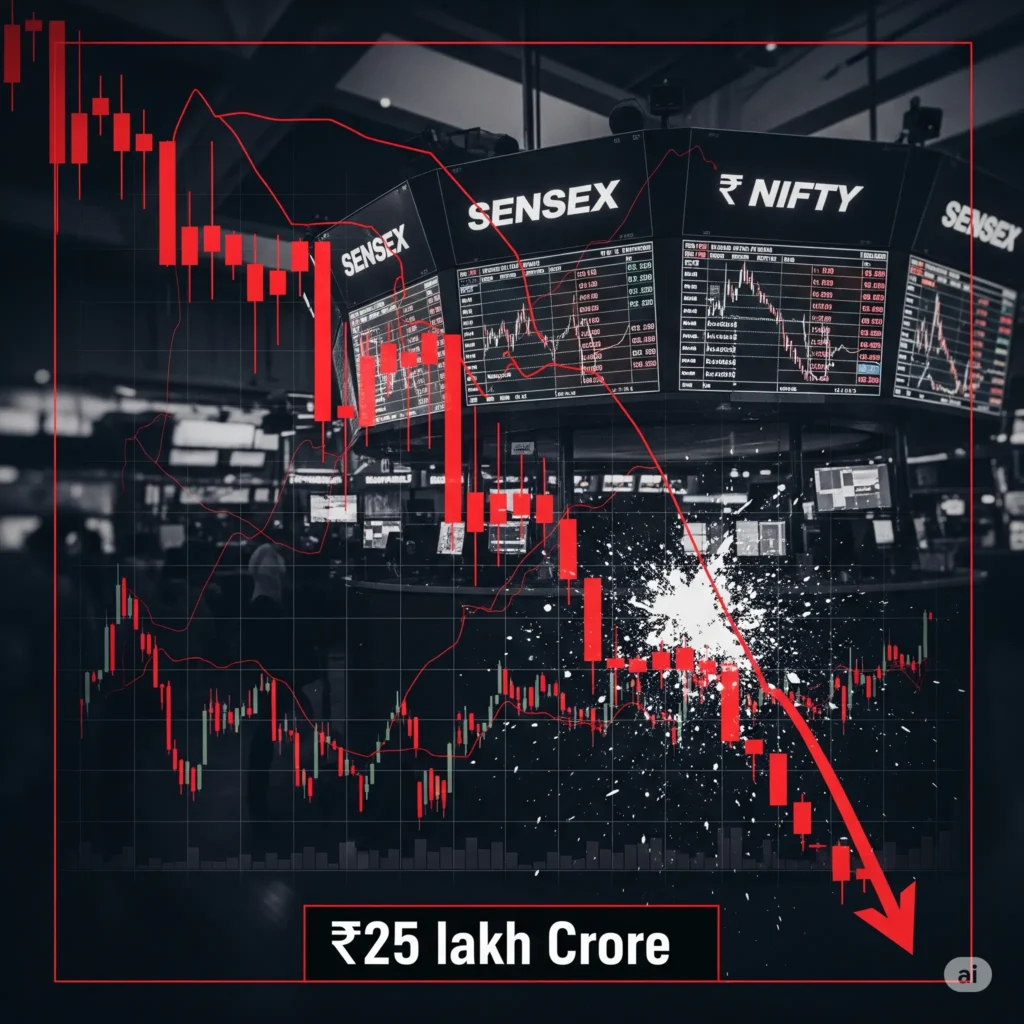

From June 27 to July 1, 2025, Indian equity markets plunged:

Over 3,200 points fell by the Sensex.

The Nifty 50 slipped away from the 21,900 mark.

More than ₹25 lakh crore investor's wealth wiped off.

This sudden and sharp fall marked a major crash, drawing comparisons to historic market slumps such as the 2008 Global Financial Crisis and the 2020 COVID-19 market meltdown.

The crash wasn’t just a financial event. It sparked discussions across economic, political, and global circles about the fragility of markets and the interconnectedness of global events. For retail investors, it was a harsh wake-up call on stock market volatility.

Key Causes of the Crash

1. Political Uncertainty and Fractured Mandate

The 2025 general elections in India did not produce a clear majority. The incumbent government lost significant ground, and no party managed to secure the 272-seat majority required to form a government. This political limbo caused concern over policy continuity, particularly regarding infrastructure spending, fiscal discipline, and foreign investment policies.

Without a stable leadership in sight, investor confidence plummeted.

2. Foreign Institutional Investor (FII) Sell-Off

FIIs played a crucial role in triggering the crash. Their confidence was shaken by the election outcome. According to data from the National Securities Depository Ltd (NSDL), FIIs withdrew over ₹14,200 crore from Indian equities in three trading sessions.

This withdrawal wasn’t only due to domestic reasons. Rising U.S. bond yields and an appreciating dollar made American assets more attractive, leading to an outflow from emerging markets like India.

3. Weak Corporate Earnings Guidance

Just before the crash, several blue-chip companies released Q1 FY26 earnings projections that failed to meet investor expectations. IT giants such as Infosys and TCS projected slower revenue growth due to weaker global demand. FMCG companies highlighted margin pressure from inflation.

Investors were already on edge post-elections, and weak earnings served as the tipping point.

4. Global Economic Headwinds

Global economic concerns were already simmering:

- The U.S. Federal Reserve signaled a delay in rate cuts to 2026.

- China’s sluggish recovery added to global demand concerns.

- Europe continued battling with stagflation.

These factors combined to create a “perfect storm,” with global and local pressures pushing Indian equities into freefall.

Immediate Consequences

1. Retail Panic Selling

Retail investors, many of whom had entered the market in the bullish post-COVID era, were caught off guard. Platforms like Zerodha and Upstox reported unusually high traffic as investors scrambled to sell their holdings.

Google Trends showed a spike in searches such as “Should I sell my stocks?” and “Market crash what to do?” — clear signs of panic-driven stock market behavior.

2. Portfolio Erosion Across Segments

HNI and retail portfolios suffered double-digit losses in sectors like tech, banks, and mid-caps. Even well-diversified mutual funds saw NAVs fall by 5–8%.

3. SEBI and RBI Interventions

SEBI implemented stricter trading rules, adding 58 volatile stocks under Additional Surveillance Measures (ASM). Intraday trading was curbed for high-risk scrips.

Meanwhile, RBI monitored liquidity and stood ready to conduct open market operations (OMOs) if panic extended to the bond market.

Sector-Wise Impact Analysis

Sector | % Drop | Reasons |

IT | -12% | Weak demand from global clients, slow guidance |

FMCG | -8% | Inflation eating into margins |

PSU Banks | -10.5% | Doubts over continuation of reform agenda |

Infra/Capex | -9.2% | Uncertainty around large-scale infrastructure push |

Pharma | -5% | Comparatively resilient, but impacted by volatility |

Sectors like energy and telecom saw mixed reactions, with some companies benefiting from safe-haven buying.

Global Context and Historical Comparison

India’s crash wasn’t an isolated event. Other emerging markets like Brazil, Vietnam, and Indonesia saw similar outflows during the same period. The dollar index touched a 14-month high, making EMs relatively unattractive.

Historically, India has seen market corrections post every general election with a fragmented mandate:

- 1996:

13% correction in a week after no party secured a majority.

- 2004:

‘Black Monday’ when Congress unexpectedly won.

- 2014

and 2019: Stability brought strong rallies.

This reaffirms the deep linkage between politics and the

stock market.

What Can Investors Learn?

1. Diversify Your Portfolio

Investors with only small-cap or equity exposure took the biggest hit. Those who held a mix of debt, gold, and international funds saw less erosion. Stock diversification is critical.

2. Don’t Time the Market

Trying to exit during a crash often results in missed recovery rallies. Staying invested, especially via SIPs during market crash, yields better long-term outcomes.

3. Keep an Emergency Fund

This crash reminded investors that markets don’t always behave rationally. An emergency fund helps you avoid selling in desperation.

4. Be Informed, Not Reactive

Understanding the difference between temporary volatility and fundamental change is critical. Follow SEBI regulations and avoid high-risk, uninformed trades.

Recovery Signs and Outlook

As July 2025 progresses, some signs of recovery are visible:

- FII selling has moderated.

- Nifty has regained about 2.3% from its bottom.

- RBI maintains economic growth projection at 6.7% for FY26.

- Banking sector is showing resilience with strong credit growth.

Market experts suggest a sideways trend until political clarity emerges, possibly post the monsoon session of Parliament.

Long-term investors may find this an opportune time to accumulate quality blue-chip stocks.

Expert Opinions

“India’s long-term story remains intact. Corrections like these are healthy in the bigger scheme.” — Radhika Gupta, CEO, Edelweiss AMC

“Avoid knee-jerk reactions. Stick to your goals and asset allocation.” — Nilesh Shah, MD, Kotak AMC

“Crashes are a part of investing. They test emotional discipline more than financial planning.” — Raamdeo Agrawal, Co-Founder, Motilal Oswal

The Role of Technology During Crashes

Digital platforms played a crucial role:

- Allowed 24/7 access to portfolios

- Enabled real-time alerts

- Helped financial advisors calm panicked investors via webinars and emails

Fintech platforms also saw an increase in new SIP registrations by opportunistic investors during the bottom.

How to Build a Post-Crash Strategy

- Assess Your Risk Profile Again: Has your risk appetite changed after this crash?

- Rebalance: Adjust exposure across equity, debt, and gold.

- Increase SIPs: Use lower NAVs to your advantage.

- Look for Undervalued Opportunities: Stocks with strong fundamentals but irrationally punished.

- Avoid Penny Stocks: Volatile markets often give false signals. Stick with quality.